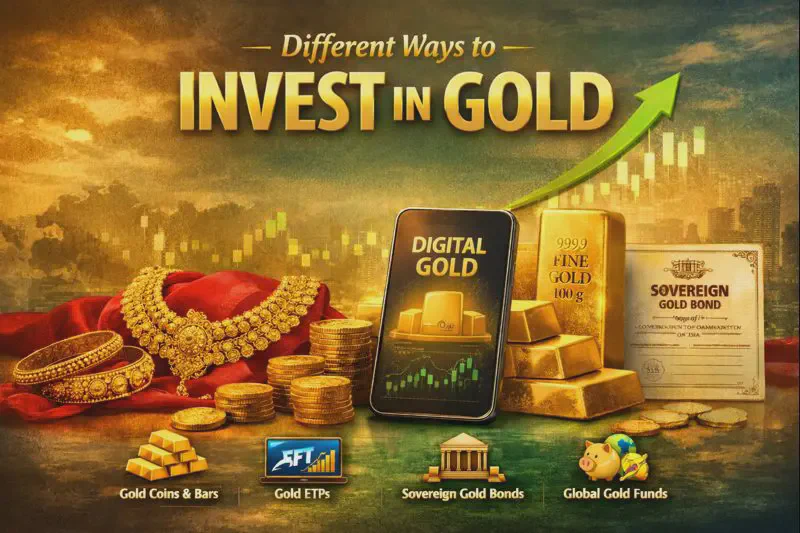

Different Ways to Invest in Gold in Kerala as Prices Surge

Gold prices have been consistently hitting new record highs in recent months, driven by global uncertainty, aggressive central-bank buying, and rising investor demand. In Kerala—where gold is not just an investment but a deeply rooted part of culture—this unprecedented price surge has left many people asking the same question:

What is the best way to invest in gold today?

This guide explains the different ways to invest in gold, their pros and cons, and which options make sense for investors in Kerala and India, while also touching on international alternatives.

1. Physical Gold (Jewellery, Coins & Bars)

🟡 Jewellery (Most Common in Kerala)

Jewellery is the most popular form of gold ownership in Kerala, especially for weddings and festivals.

Pros

- Can be used and worn

- Emotional and cultural value

- Easily available across Kerala

Cons

- Making charges (8%–25%)

- Wastage and GST increase cost

- Lower resale value compared to pure gold

Best for: Cultural use, long-term holding, not ideal for pure investment.

🟡 Gold Coins & Bars (Better than Jewellery)

Buying 22K or 24K coins/bars from banks or reputed jewellers is a more investment-friendly option.

Pros

- No making charges (or very minimal)

- Higher purity (usually 24K)

- Easy to resell

Cons

- Storage and safety issues

- No interest or income

Best for: Traditional investors who want physical gold without jewellery losses.

2. Digital Gold (PhonePe, Google Pay, Paytm, Jar)

Digital gold has become popular in India, especially among young investors.

How it works: You buy gold online in small amounts (even ₹100). The gold is stored securely by partners like MMTC-PAMP or SafeGold.

Pros

- Start with very small amounts

- No storage worries

- Can be converted to coins or jewellery

Cons

- Not regulated by SEBI

- Buy–sell spread can be high

- Long-term tax clarity still evolving

Best for: Beginners, SIP-style gold buying, convenience lovers.

3. Gold ETFs (Exchange Traded Funds)

Gold ETFs are traded on Indian stock exchanges like shares and track gold prices.

Pros

- Pure price exposure to gold

- High liquidity

- No storage or theft risk

- Regulated and transparent

Cons

- Requires a demat account

- Brokerage + expense ratio

- Not usable as physical gold

Best for: Investors already active in the stock market.

4. Sovereign Gold Bonds (SGBs) – Government-Backed Gold

SGBs are issued by the Government of India and are one of the most efficient gold investments.

Key benefits

- Price linked to gold

- Extra 2.5% annual interest

- No capital gains tax if held till maturity (8 years)

- No storage risk

Limitations

- Lock-in period

- Not always available (issued in tranches)

- Market price may differ if sold early

Best for: Long-term investors who don’t need physical gold.

5. Gold Mutual Funds

These funds invest in Gold ETFs and offer indirect exposure.

Pros

- SIP option available

- Managed by professionals

- No demat required

Cons

- Slightly higher expense ratio

- Returns depend on ETF performance

Best for: SIP investors who prefer mutual funds over direct stocks.

6. Gold Savings Schemes (Jewellery Store Plans)

Many jewellery shops in Kerala offer monthly gold savings schemes.

How it works: You pay a fixed amount every month, and after 10–12 months you can buy jewellery.

Pros

- Useful for planned jewellery purchases

- Bonus months or discounts

Cons

- Locked to one store

- Not ideal for investment returns

- Risk if jeweller shuts down

Best for: Wedding or festival jewellery planning—not for pure investing.

7. International Gold Investment Options

For those looking beyond India:

🌍 International Gold ETFs

- SPDR Gold Shares (GLD)

- iShares Gold Trust (IAU)

Note: Indian residents need a global investing account and must consider currency risk, taxes, and regulations.

Best for: Experienced investors with international exposure needs.

Which Gold Investment Is Best Right Now?

| Goal | Best Option |

|---|---|

| Long-term wealth protection | Sovereign Gold Bonds |

| Easy & flexible investing | Gold ETFs / Digital Gold |

| Cultural & personal use | Jewellery |

| Short-term trading | Gold ETFs |

| Small monthly investing | Digital Gold / Gold MF SIP |

Final Thoughts for Kerala Investors

Gold will always hold a special place in Kerala—both emotionally and financially. But as prices rise, how you invest matters more than ever.

Instead of putting everything into jewellery:

- Combine SGBs for long term

- Use ETFs or digital gold for flexibility

- Buy jewellery only when you actually need it

A balanced approach helps you benefit from gold’s strength without unnecessary costs.

1 GM 24K (999.9+) Pure Gold Coin - Rose Design

This 1 gram 24K (999.9+) pure gold coin features an elegant rose motif and is minted by a certified refinery. Ideal for gifting, small investments, or conversion into jewellery, it comes with assured purity and buyback support as per seller terms.

- ✔ Individually numbered CertiCard

- ✔ Assured buyback at live market price

- ✔ BIS & LBMA certified purity

- ✔ Ideal for gifting & small investments

As an Amazon Associate, we may earn a commission from qualifying purchases without any additional cost to you.

Related Articles

Digital Gold in India: Is It a Smart Way to Invest in Gold Today?

In our previous post, we explored the various ways to invest in gold—from jewellery and coins to …

Read more →Gold May Cross $5,000: Is ₹15,000 per Gram Next for Kerala 22K Gold?

Gold prices are once again in the spotlight. Global markets are increasingly discussing the …

Read more →US–Venezuela Crisis: Impact on Gold Rates in Kerala

The financial world has been jolted by dramatic geopolitical news: U.S. forces conducted a …

Read more →