How International Gold Prices Affect Gold Rates in Kerala

Gold prices in Kerala don’t change randomly. While local demand, festivals, and making charges play a role, the biggest influence comes from international gold prices. If you’ve ever noticed gold rates rising or falling suddenly in Kerala, chances are the reason lies beyond India’s borders.

In this article, we’ll explain how global gold prices impact Kerala gold rates, in simple terms, so buyers and investors can better understand daily price movements.

1. Gold Is Priced Globally in US Dollars

Gold is traded internationally in US Dollars (USD), primarily on global commodity exchanges like:

- London Bullion Market

- COMEX (New York)

- Shanghai Gold Exchange

When the international gold price per ounce changes, it directly affects gold prices in India — including Kerala.

Example:If gold prices rise globally due to economic uncertainty, Kerala gold rates usually increase the same day or the next.

2. Impact of USD–INR Exchange Rate

Even if international gold prices remain stable, Kerala gold rates can change due to currency fluctuations.

- When Indian Rupee weakens against the US Dollar, gold becomes more expensive in India.

- When Rupee strengthens, gold prices may fall locally.

Why this matters:

India imports most of its gold. A weaker rupee means importers pay more in INR for the same amount of gold.

3. Global Economic Uncertainty & Safe-Haven Demand

Gold is considered a safe-haven asset during times of uncertainty, such as:

- Global recessions

- Inflation fears

- Banking crises

- Stock market crashes

When global investors rush to buy gold:

- International demand rises

- Gold prices increase globally

- Kerala gold rates follow the same upward trend

This is why gold prices often rise during global economic instability.

4. Influence of US Interest Rates & Inflation

US Federal Reserve decisions play a major role in gold prices.

- Higher interest rates → Gold prices usually fall

- Lower interest rates → Gold prices often rise

Why?Gold doesn’t earn interest. When interest rates are low, gold becomes more attractive compared to savings or bonds.

Since global gold prices react to US monetary policy, Kerala gold rates are indirectly affected as well.

5. Import Duties and Taxes in India

While international prices set the base, Indian government policies add another layer.

Key factors include:

- Import duty on gold

- GST on gold jewelry

- Customs regulations

If import duties increase:

- Gold becomes costlier in India

- Kerala gold rates rise even if global prices are stable

6. Local Demand in Kerala vs Global Prices

Kerala has one of the highest gold consumption rates in India, especially during:

- Weddings

- Onam & Vishu

- Festival seasons

However, local demand usually adjusts prices only slightly. The main price driver is still international gold markets.

Local demand mainly affects:

- Making charges

- Short-term premium differences

7. Why Kerala Gold Rates Change Daily

Daily gold rate changes in Kerala are due to a combination of:

- International gold price movements

- USD–INR exchange rate changes

- Bullion market opening prices in India

- Local jewellers’ adjustments

That’s why tracking daily updates is important for buyers and investors.

Conclusion

Gold rates in Kerala are closely connected to global financial markets. Understanding international gold prices, currency movements, and global economic trends helps you make smarter buying decisions.

Whether you’re purchasing gold jewelry or investing for the long term, staying informed about global influences on Kerala gold rates can help you time your purchase better.

👉 For accurate daily updates, check KeralaGoldRates.com every day.

1 GM 24K (999.9+) Pure Gold Coin - Rose Design

This 1 gram 24K (999.9+) pure gold coin features an elegant rose motif and is minted by a certified refinery. Ideal for gifting, small investments, or conversion into jewellery, it comes with assured purity and buyback support as per seller terms.

- ✔ Individually numbered CertiCard

- ✔ Assured buyback at live market price

- ✔ BIS & LBMA certified purity

- ✔ Ideal for gifting & small investments

As an Amazon Associate, we may earn a commission from qualifying purchases without any additional cost to you.

Related Articles

Digital Gold in India: Is It a Smart Way to Invest in Gold Today?

In our previous post, we explored the various ways to invest in gold—from jewellery and coins to …

Read more →Gold May Cross $5,000: Is ₹15,000 per Gram Next for Kerala 22K Gold?

Gold prices are once again in the spotlight. Global markets are increasingly discussing the …

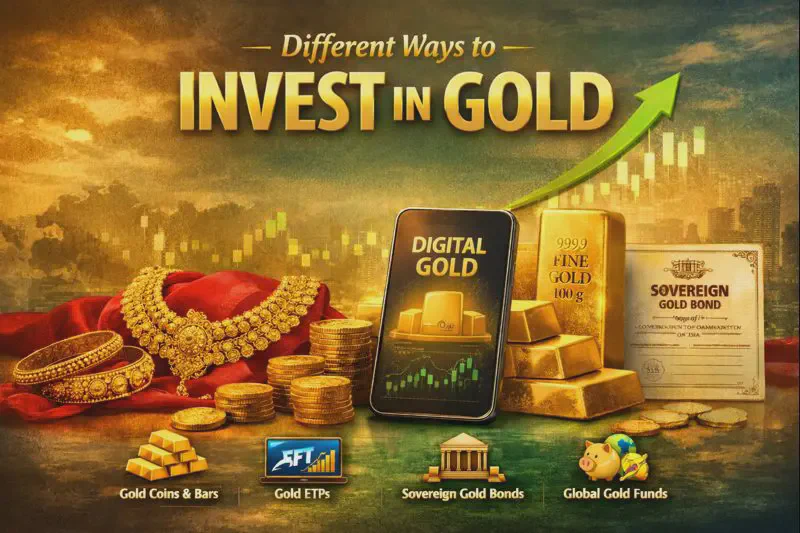

Read more →Different Ways to Invest in Gold in Kerala as Prices Surge

Gold prices have been consistently hitting new record highs in recent months, driven by global …

Read more →